To one who is concerning about his or her future

Many people are concerning about the pension. Some are still trying to figure out their problem. Even if they consulted with consulars, they could not find their problem. Therefore, in order to solve the problem, we must understand reasons that cause them anxiety.

“How much saving do we need after our retirement”

“Does deposit money in the bank enough”

These are some questions we should look into and discuss about them.

Have you start planing your retirement

Many people deposit money into the bank or buy insurance in order to prepare their retirement. In fact, there are more then 80% of people that feel insecure about their retirement.

Many people deposit money into the bank or buy insurance in order to prepare their retirement. In fact, there are more then 80% of people that feel insecure about their retirement.

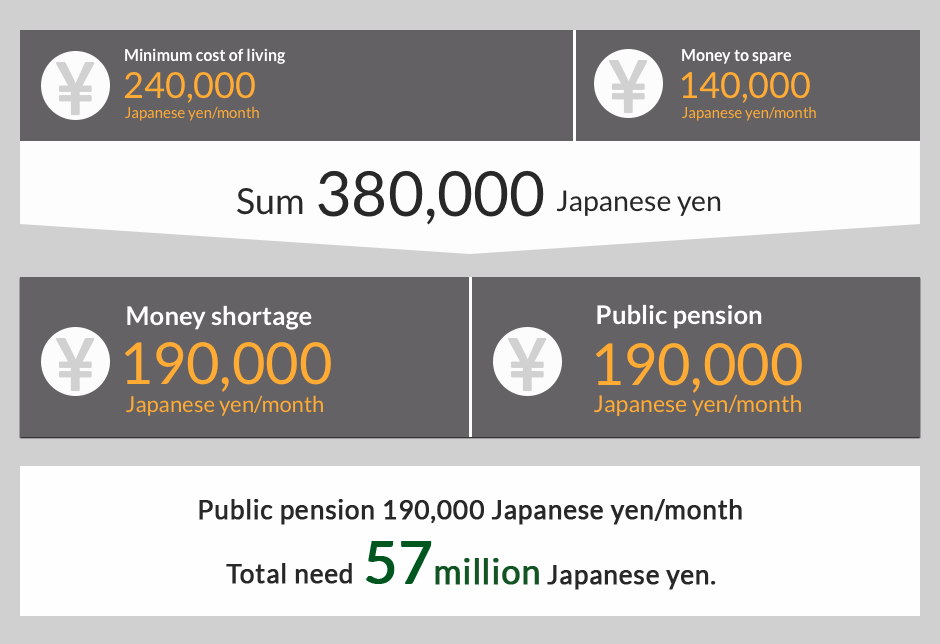

According to the Ministry of Internal Affairs and Communication, MIC) Family Income and Expenditure Survey in 2007, a senior couple without support spends approximately 237,000 Japanese yen per month. Meanwhile, pension from the government for senior couple is 230,000 Japanese yen. If you want to live in a comfortable life, then at least 57million Japanese yen was necessary. That is to say, government pension is not enough to afford your reitrement.

What should you do? Only insurance and saving enough?

If we used our pension smartly then problem sloved. If you think like that, you should get rid of that idea as soon as possible. This is because the pension from our governement is about 50% of your salary, and one day you will use it all up. Moreover, rule of pension has possibilty to change any time. If you rely entirely on pension, then it is difficult for you to live a comfortable life after retirement.

Is this counterplan reliable?

Nowaday, the deposit interest is approximately 0.1%. Even if you deposit 10 million yen, you will only get 10,000 yen as your interst per year. As for a high-yield financial product, risk is high as well. Moreover, money that you depost in the bank or insurance that you bought might devalued, due to inflation.

For instance, you bought a pen that cost you 100 Japanese yen, now you need to use 200 Japanese yen in order to buy a pen. Therefore, commodity price double, but your deposit stays the same. That is to say, the value of money that you have been saving is now reduced by half.

Your did not do antyhing and all the sudden your money’s value goes down.

In order to resist inflation, one must buy property that appreciate when commodity price inflated, for example, stock or real estate, etc.

In a long term, using part of your deposit to buy stock or real estate is the most ideal method.

We provide you a brighter future

Goodcom Asset provides professional consuler that helps you relieve anxiety. We provide best asset management advice that will lead you to more comfortable and happily life. In order to make sure our customer’s profit is maximized, we recommand high-quality real estates for our customer.

Moreover, in order to let our customer’s asset management run smoothly, we also provide personal and customize support system.