About Property Investment

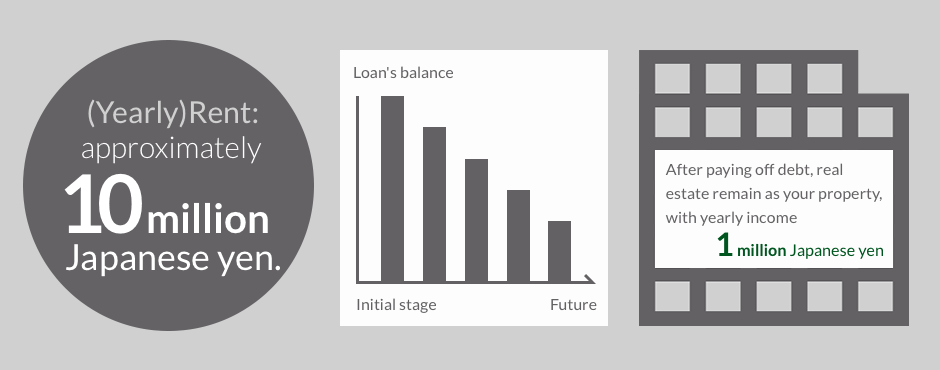

Property investment is becoming a mansion owner and rent your mansion to a third party for rent income. Even if you used mortgage loan to buy this property, you can use rent income to pay off your mortgage loan.

Property investment is a great way to solve pension, inheritance tax, and inflation problem. Therefore, property investment is popular among salary men and public officials. Moreover, joining a so-called group credit life insurance can replace life insurance.

※ About group credit life insurance

Credit life insurance is a life insurance policy designed to pay off a borrower’s debt if that borrower dies or disable.

Use rent income to pay off mortgage loan. After paying off all the debt, rent income become your personal

Merit of property investment

- small amount of money and you can start your investment

Some places, you do not need down payment and you can start your investment - For better retirement life, make sure you have enough pension!

You do not need to rely entirely on public pension - Inheritance tax reduce

Less than 30% compare to other apartment - Replaces life insurance so you are prepared even if something happened

Leave your family with property and stable income - Resist inflation

Your property will not depreciate even inflation occurred.

Demerit of property investment

- high-yield investment depends on examination

higher yield compare to the bank - interest goes up and risk of currency exchange

if there is trouble, choose a company that has proper support system - No resident, no income

select guarantee income system - Building aging or risks such as earthquake, fire, etc

land will be your eternal property